Retiring Smarter Promotes Retirement Literacy

Retiring can be complicated.

The more you know about retirement the better decisions you can make.

Begin your retirement journey with consumer-based education and written planning.

Who We Serve

Companies & Businesses

Learn More

Churches

Not-For Profits

A word from our Founder:

Most Americans do not have their retirement ducks in a row....

- Millions of Americans are stressed about retiring in the coming years.

- 80% of baby-boomers scored 'F' on a basic retirement test. (3)

- Only 4% of retirees claim Social Security at the most optimal time. (2)

- Remaining 96% losing an average of $111,000 per household. (2)

- High stock valuations coupled with record low interest rates make planning a challenge.

- 75% of those nearing retirement have no written income plan.

- 60% percent of Baby Boomers fear running out of money in retirement more than dying. (1)

Fear of retirement unknowns can be stressful.

- Can I retire and not outlive my savings?

- When is my optimum time to begin retirement?

- When should I start taking Social Security?

- How much should I withdraw from my retirement accounts and when?

- What is my proper investment risk allocation?

- How do I improve my health in retirement?

- How will the new tax laws affect my retirement?

- What's my plan for long-term care issues?

- What Medicare option is best for me?

- How should I manage RMDs (required minimum distributions)?

- Is a will or trust best for my unique situation?

- What is my housing plan for old age?

Your retirement ducks...are they all in a row?

Retiring Smarter is

- 1 1/2 day interactive workshop

- Covers 40 relevant topics important to those 55 and older

- Money and health focused

- Each student is assisted in developing their own written retirement plan.

The workshop combines four empowering elements:

- Live instruction from knowledgeable teachers

- Entertaining videos

- 100-page take-home workbook presented in an engaging, easy-to-understand format

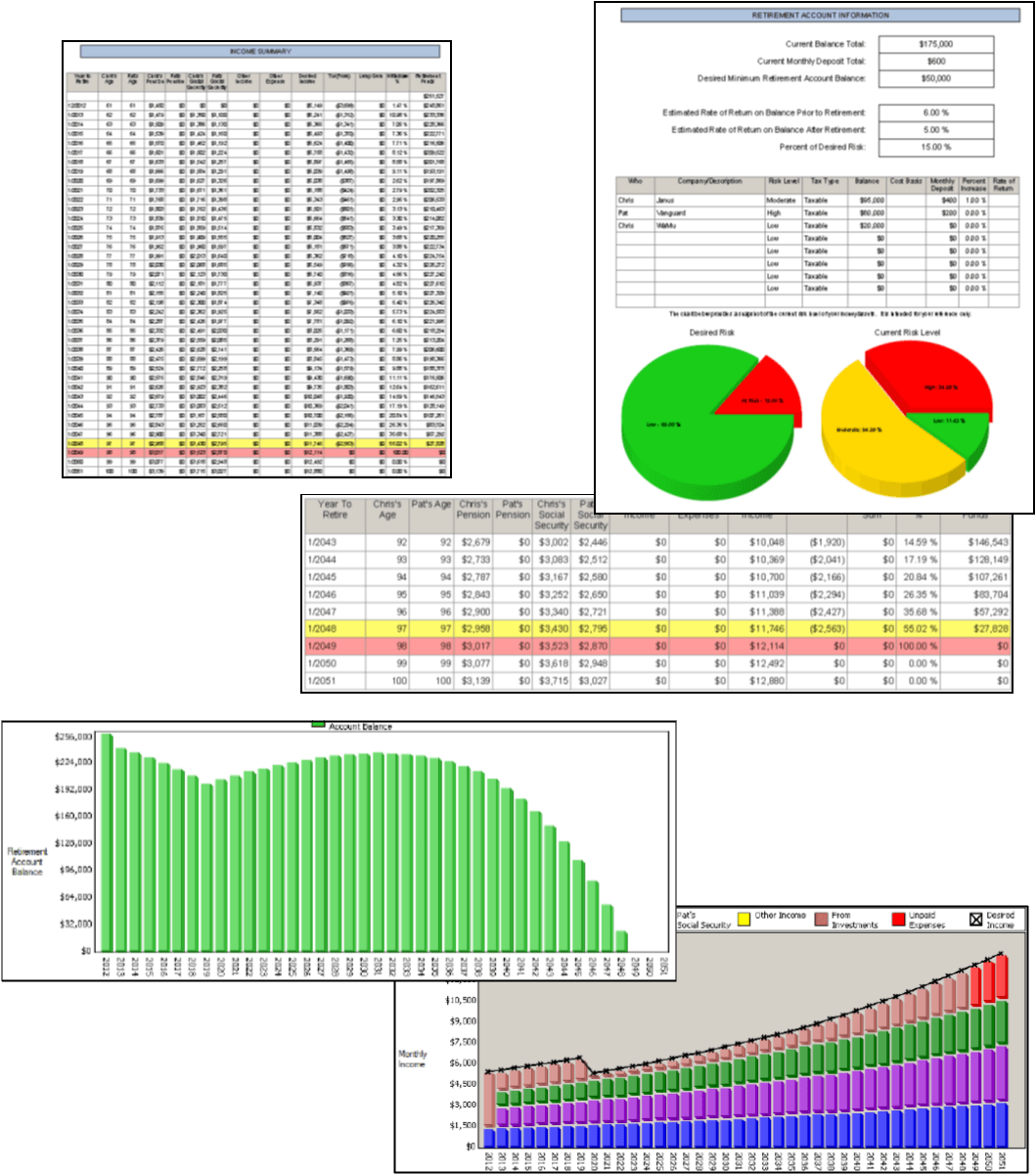

- A customized retirement income plan built in class by each student

Retiring Smarter addresses these and other relevant issues:

- Inflation-Adjusted Income Planning

- Personal Health and Medicare

- Tax Reduction Strategies

- Social Security Maximization

- Insurance Efficiencies

- Pension Maximization

- Adult Children and Money

- Estate Planning

- Investment Alternatives

- Tax Efficient Giving to Church and Charity

- Risk Management of Investments

- Long-Term Care Issues

- Investment Strategies for Older Investors

- Retirement Housing

Pay-It-Forward Scholarship Program

- Course tuition is $199 per household and includes both class and written income plan.

- Money back guarantee if not totally satisfied.

- Most students attend without upfront tuition using a Pay-It-Forward scholarship.